Managing Sponsored Projects Awarded in Foreign Currency (for PAMC/Campus)

Sponsored projects awarded in a foreign currency present unique challenge. It is important to routinely conduct a thorough analysis to manage the award, understand impact of exchange rate variations and minimize any possible financial risk.

Overview

Sponsored projects awarded in a foreign currency pose a high level of risk due to the fluctuations in exchanges rates. Departments and units that accept awards in a foreign currency are responsible for understanding and managing the impact of these fluctuations on spending, invoicing, burn rates, and overall project management. Unless otherwise stated in the agreement, financial management of the project should utilize the current exchange rate not the initial exchange rate at time of the award.

Guidelines

Duke’s preference is to receive awards in US Dollars (USD). Preaward offices will attempt to negotiate terms to allow for invoices, payment, and reporting in USD. In some cases, a sponsor is only able to award in a currency other than USD. Duke will process awards in a foreign currency with the understanding that the department acknowledges that payments to Duke made in foreign currency are subject to losses or gains based on currency exchange fluctuations. By accepting the terms, the department agrees that any currency exchange loss on this award is the responsibility of the PI and/or the PI’s Department/School/Institute/Center. The Grant Manager, Department Administrator, and PI are responsible for understanding the impact of the fluctuations in the exchange rate throughout the project while monitoring the amount of remaining funds in SAP (recorded in USD).

To mitigate the risk associated with fluctuations in the exchange rate, agreements can be negotiated to collect the entire award amount upon full execution of the agreement, a portion of the award amount in advance, or via scheduled payments. Cost reimbursable awards present an increased risk since the exchange rates fluctuate frequently. When negotiating sub agreements related to awards issued in a foreign currency, it is recommended that a payment schedule be established to avoid additional risk. These projects should be monitored closely to proactively plan for any unexpected impact of the exchange rate fluctuations.

Financial systems at Duke use USD for financial tracking and reporting. Departments managing, or involved with, projects awarded in foreign currency must be able to assess and make determinations based on the variances between the USD and the foreign currency. The fluctuations in the exchange rate should be considered throughout the life of the project and adjustments made as needed. TBS and PAFM record information as invoices are issued and payments are made to assist with accounting for the exchange rate impact. The department should work with TBS to make the necessary adjustments to account for continued fluctuations in the exchange rate when necessary.

Institutional reports and invoices are ordinarily issued in USD. However, in the event these invoices requirement payment in a currency that is not USD, the Oanda currency calculator is used to determine the exchange rate as specified by the award terms and conditions. Fluctuations in the exchange rate are to be expected and may occur at any time during the life of the project (i.e. during invoice preparation, when funds are transferred, or submission of a routine report) unless the agreement specifies an average negotiated rate throughout the life of the project.

Roles & Responsibilities

Preaward Office (ORS)

The Office of Research Support (ORS) is responsible for proposal submission, agreement negotiations, and confirming all required documentation is complete prior to set up of a sponsored project.

Amendments, modifications, and other items requiring input or approval by a Duke Authorized Signing Official are also processed through this office.

ORS should be consulted and included in

- Discussions related to clarifications, interpretations or concerns related to terms and conditions of the award

- Communications with the sponsor related to administrative topics or those with a financial impact

Department/Unit

The department is responsible for monitoring the exchange rate fluctuations routinely and understanding how the variations impact the project’s overall financial status. Partner with the appropriate central office to make the necessary adjustments throughout the life of the award. Monthly monitoring of the exchange rates may be needed to minimize the impact to the project as well as any financial risk for the department.

Department/Unit: Grant Manager

Proposal Development

- Engage appropriate ORS representatives in advance of submitting the proposal in SPS

- Discuss topics similar to the examples below:

- Special requirements for the proposal since the budget will be submitted in a foreign currency

- Completion of the required attestations

- Currency Attestation: Proposal (included with initial SPS submission)

- Currency Attestation: Award (needed at time of award)

- FOA/Sponsor guidance that may need special consideration

- Consider a proposal preparation discussion to identify possible proposal challenges, engage manager or team lead if necessary

- Discuss topics similar to the examples below:

- Provide all relevant details with proposal upon submission

Award Set-up

- Understand and communicate any financial risk associated with awards issued in a foreign currency on behalf of the department/school/institute

- Verify project master data in SAP upon receipt of the award

- Items to verify include, but are not limited to: award amount, LOC attribute, funding basis, currency, project related dates, PI, GM2, etc.

- Coordinate a project kick-off meeting to address commitments, responsibilities and deadlines with all involved

- Attendees may include: GM2, PI, business office staff (payroll, procurement, Business Manager, etc), PAFM liaison, TBS Award Set-up, ORS, IRST, CAMT, etc.

- Discussion topics could include:

- How will revenue be received and how frequently?

- How will expenses be reported and how frequently?

- Note that the level of complexity increases if a project is awarded as cost-reimbursable

- Who is responsible for creation and submission of reports? Invoices?

- If the department is responsible, is there a template?

- What, if any, institutional review is needed?

- If the department is responsible, is there a template?

- Identify best practices to mitigate risk of currency loss on this project

- Discuss strategies to effectively manage the currency conversion

- How frequently will TBS/PAFM review USD budget amount in SAP’s ITD Plan?

Post Award

- Understand that SAP records transactions in US dollars, there is not an automatic mechanism to convert these to a different currency

- Review the currency exchange rate for impact of the fluctuations on award spending and projections

- Routinely adjust projections to account for changes in the exchange rate

- Adjustments to projections are recommended at least quarterly

- NOTE: TBS adjusts plan in SAP periodically to account for invoice and revenue variations due to the exchange rates

- Ensure that applicable expenses are recorded on the project (i.e. effort, lab supplies) to provide accurate reporting of financial support necessary to complete the project

- Monitor trends in the fluctuations, i.e. continuously increasing or decreasing in value since this will greatly impact long-term goals of the project

- Routinely adjust projections to account for changes in the exchange rate

- Understand ledger postings (revenue, invoices & payments) to ensure these are occurring as expected and align with project plan

- Revenue should be monitored using SAP transaction FBL5N

- Communicate with managers and PI when exchange rate fluctuations will cause noteworthy impact to the project

- Adjust for fluctuations that impact the project aims:

- Discuss cost-sharing options if exchange rate is negatively impacting the project

- Consider possible options as permitted by the sponsor, such as

- Request increased funding if the exchange rate cannot be covered with existing funds

- Adjust scope to allow for the reduction will have to be drastically reduced

Closeout

- Identify any currency conversion questions at beginning of the closeout period (90 days prior to end date)

- Communicate concerns with PAFM and CAMT as soon as they are identified to mitigate risk of missing closeout and reporting deadlines

- Note that SAP is showing award, invoice and transaction amounts in USD, consider exchange rate impacts

- Report final balance in USD on the required closeout documentation while considering, and noting if possible, impact of exchange rate on previous or future invoices/reports to the sponsor

- Complete the Closeout Tasklist per institutional guidance

- Balance should be recorded in USD on the form to align with SAP

- Balance information in foreign currency can be recorded in the comment field if required by department/center/institute/school

- Include other applicable comments and/or attachments

- Balance should be recorded in USD on the form to align with SAP

- Complete the PI Attestation per institutional guidance

- Balance should be in USD to align with balance in SAP

- Insert supporting comments related to the balance in foreign currency to describe the impact of exchange rate impact

- If there is an overdraft, note any information to inform the PI in advance that it will post to the backstop code

- For example: overdrafts caused by fluctuations in the exchange rate

- Complete the Closeout Tasklist per institutional guidance

Department/Unit: PI

- Accepts financial risk associated with awards issued in a foreign currency

- Participate in project kick-off meeting, if needed

- Communicate important factors related to the project with the grant manager

- For example: updated/estimated deliverable schedules, deliverable delays, details during project that impact financials or agreement terms, etc.

- Partner with grant manager to adjust for fluctuations that impact the project aims, if necessary

Post Award Central Offices

Central offices at Duke maintain their standard responsibilities and procedures regardless if the award is issued in US Dollars or a foreign currency. Few exceptions are in place to accommodate for awards in foreign currency since the department is responsible for the impact of the exchange rate fluctuations. An overview of the responsibilities for these offices is below.

PAFM – Post Award Financial Management

- Issue invoices and financial reports in specified currency as directed by agreement terms and conditions

- Invoices may be issued using the current exchange rate, the negotiated exchange rate at time of award, or other conversion based on the agreement

- Review any financial information requested by the sponsor prior to release by department, PI or other institutional entity

- Departments should not communicate financial information with sponsor unless previously approved by PAFM

TBS Award Set up

- Review plan in SAP in relation to invoice vs. payment amounts

- Make adjustment to plan, in G/L 99600, as needed to allow for impact of fluctuation in the exchange rates

CAMT - Campus Award Management Team

- Assist with general ledger questions and closeout process

Process and approve closeout submissions

Other Considerations

Challenge: SAP only recognizes award amounts, records transactions, and reports in USD

- Understand the exchange rates impact

- Positive rate change = currency gain

- Negative rate change = currency loss

- Currency gain when a payment is posted will post to a 996x G/L

- The department can rebudget if they choose, however it is important to remember that a positive rate change for one invoice may be needed to cover currency loss on a future invoice

NOTE: The decision to rebudget should be made collectively by the PI, GM and department leadership since any future loss is assumed by the PI and unit

Challenge: Invoices in same budget period may use different exchange rates

- Review and record information for individual invoices during your monthly financial analysis.

- Include details such as: invoice date, amount in USD, amount in foreign currency, and the exchange rate used

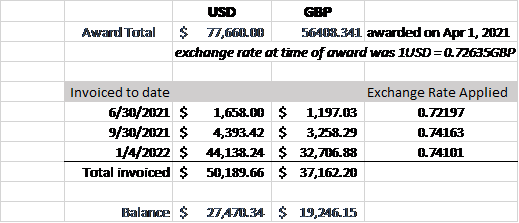

For Example: (below is an example with quarterly invoices in British Pounds)

- Use SAP transaction FBL5N to review invoice specifics

- This will include the payment amount over/under based on the currency exchange rate. If there is a favorable currency conversion rate, AR will make a note

- Click here for step-by-step instructions on executing FBL5N

- Annual/routine financial reporting is difficult since multiple exchange rates may be used within the same budget or project period

- Understand how the exchange rate is applied (i.e. at time of invoice, negotiated rate, when payment is received, etc.)

- Maintain record of invoice amounts in USD and foreign currency, noting the exchange rate applied (see example in #1a)

Challenge: Projections are difficult because expenses are recorded in SAP based on USD

- Plan amounts are entered in SAP when the project is awarded, however this can be revised based on the impact of exchanges rate variations

- Grant manager should coordinate with TBS Award set-up to review the budget quarterly and assess the need for plan adjustments based on currency gain or loss

- There are specific G/Ls used for these types of adjustments therefor SAP changes due to exchange rates should only be processed by TBS.

- Grant manager should coordinate with TBS Award set-up to review the budget quarterly and assess the need for plan adjustments based on currency gain or loss

Challenge: Awards issued in foreign currency as cost reimbursable present a higher risk than scheduled payments/deliverable/fixed price

- Refer to guidance related to above challenges.

- Communicate with PI frequently to determine impact and discuss how they would prefer to address the difference